Subscribe and get a free printable weekly meal plan that will save you money!

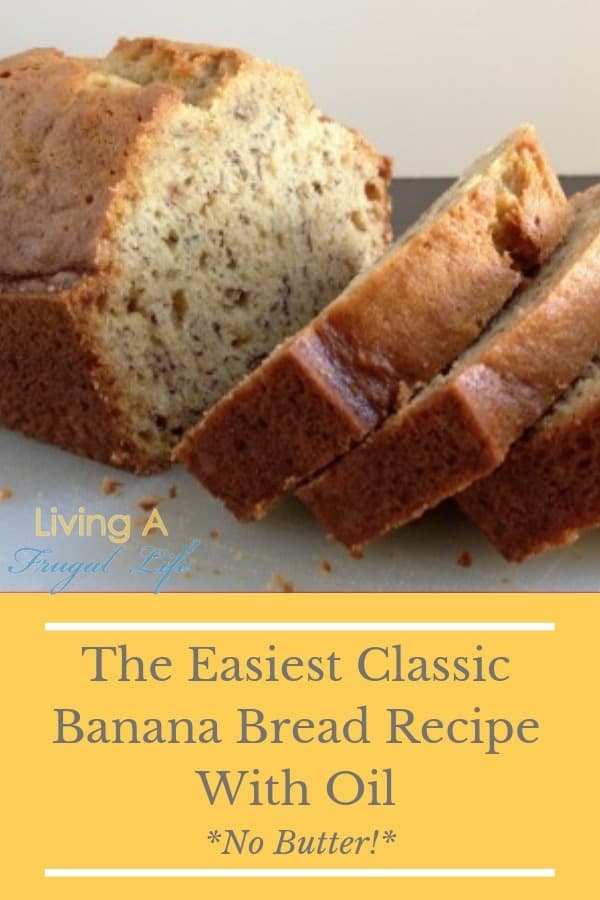

The Easiest Classic Banana Bread Recipe With Oil *No Butter*

Classic banana bread recipes are sometimes hard to come by. Especially when you need a dairy free recipe. I have found a way to have the super moist texture of classic banana bread with oil rather than butter. And it is SO easy too! When I was younger My grandma and I would make this…

Snowy Reindeer Custom Christmas Ornament Made With Dollar Store Items

Some of the best custom Christmas ornament crafts are the ones where you use ordinary items in unordinary ways. With this DIY snowy reindeer ornament, you will be using some basic dollar store items in some new and exciting ways to get this gorgeous result. All you need is a few supplies, and you will…

5 Tips to Help You Be an Expert Money Saver

I was born an expert money saver. When I was 6, I received a book from my grandma with $10 in $2 bills. I still have every one of those! My husband, on the other hand, was not born that way. He was a born spender. Saving money does not come easily for him, but…

Hey!!!! I am Melissa! I am a mother and wife that loves to live frugally, spend time with my family and help others. I think love goes a long way and respect goes even further. I am real on this site because life isn’t always sunshine and rainbows. You’re not alone through all this and I want you to feel right at home. Join me in the ups and downs of frugal life and raising a family in a time where choosing the right isn’t always popular.

Hey!!!! I am Melissa! I am a mother and wife that loves to live frugally, spend time with my family and help others. I think love goes a long way and respect goes even further. I am real on this site because life isn’t always sunshine and rainbows. You’re not alone through all this and I want you to feel right at home. Join me in the ups and downs of frugal life and raising a family in a time where choosing the right isn’t always popular.

Recent Posts on Living A Frugal Life

14 Ways to Quickly Save Money In The Home

The Best Simple Pumpkin Squares Recipe

Gardening

DIY Raised Garden Beds

How to Build a DIY Composting Bin for Home Composting

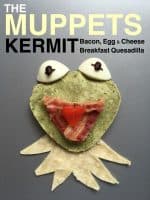

How to Build a Raised Vegetable Garden

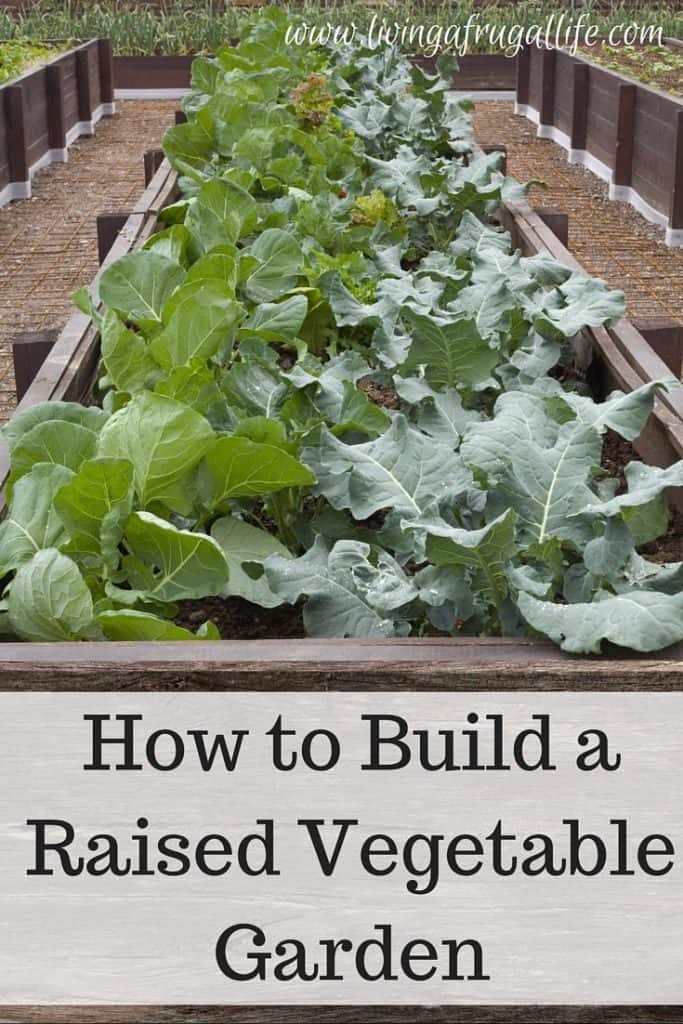

How to Build a Garden Box That is Perfect for Square Foot Gardens

Hey!!!! I am Melissa! I am a mother and wife that loves to live frugally, spend time with my family and help others. I think love goes a long way and respect goes even further. I am real on this site because life isn’t always sunshine and rainbows. You’re not alone through all this and I want you to feel right at home. Join me in the ups and downs of frugal life and raising a family in a time where choosing the right isn’t always popular.