Subscribe and get a free printable weekly meal plan that will save you money!

-

How to Save on a Rental Car

I don’t have to use a rental car often, but when I do I try to save as much as possible. There are ways to save on rental cars and knowing how to save on the rental can help you put a dent in your vacation budget. I’ve put together a list of ways that…

-

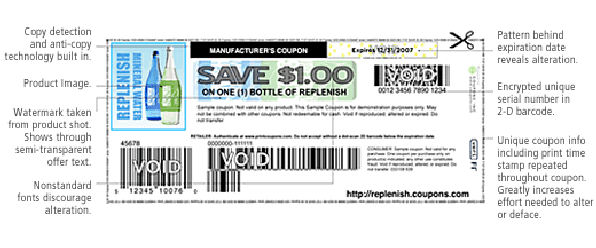

Save Money On Grocery Shopping By Reading Your Sales Flyer

Save Money On Grocery Shopping By Reading Your Sales Flyer There are many simple ways you can save money on groceries. One way that helps in saving money on groceries is to get to know how to read your sales flyer. As you get to know you sales flyer, it is important to know the…

-

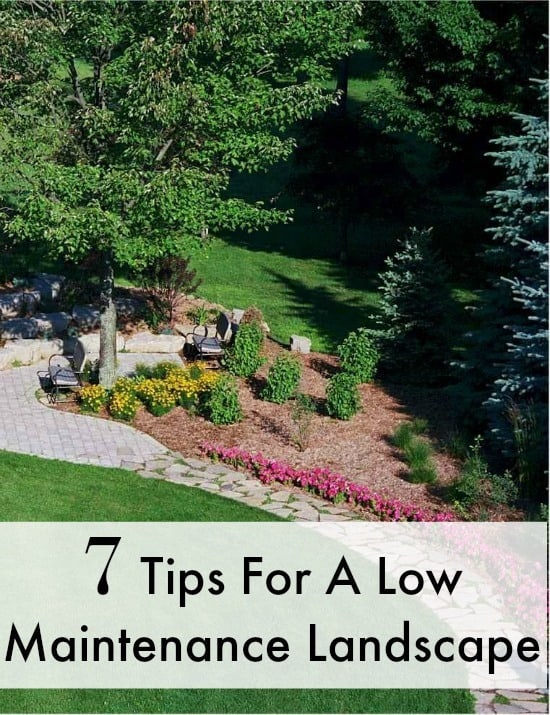

7 Tips For A Low Maintenance Landscape

Low maintenance landscape is useful for so many different types of people in so many different situations. Some like it because they are busy, others for drought and others for tools needed for maintenance.

Hey!!!! I am Melissa! I am a mother and wife that loves to live frugally, spend time with my family and help others. I think love goes a long way and respect goes even further. I am real on this site because life isn’t always sunshine and rainbows. You’re not alone through all this and I want you to feel right at home. Join me in the ups and downs of frugal life and raising a family in a time where choosing the right isn’t always popular.

Hey!!!! I am Melissa! I am a mother and wife that loves to live frugally, spend time with my family and help others. I think love goes a long way and respect goes even further. I am real on this site because life isn’t always sunshine and rainbows. You’re not alone through all this and I want you to feel right at home. Join me in the ups and downs of frugal life and raising a family in a time where choosing the right isn’t always popular.

Recent Posts on Living A Frugal Life

Beef and Asparagus Meal for Two

14 Ways to Quickly Save Money In The Home

Gardening

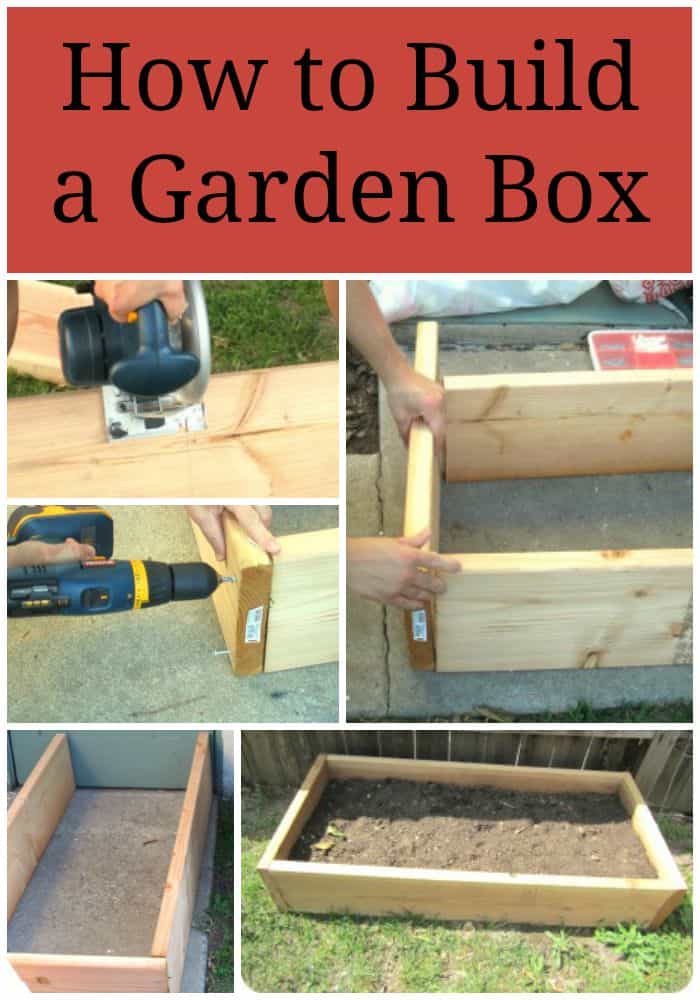

How to Build a Garden Box That is Perfect for Square Foot Gardens

Easy Fall Vegetables to Plant That Are in Season + List of Vegetables to Plant in the Fall and Winter

How to Garden And Care for Small Vegetable Gardens

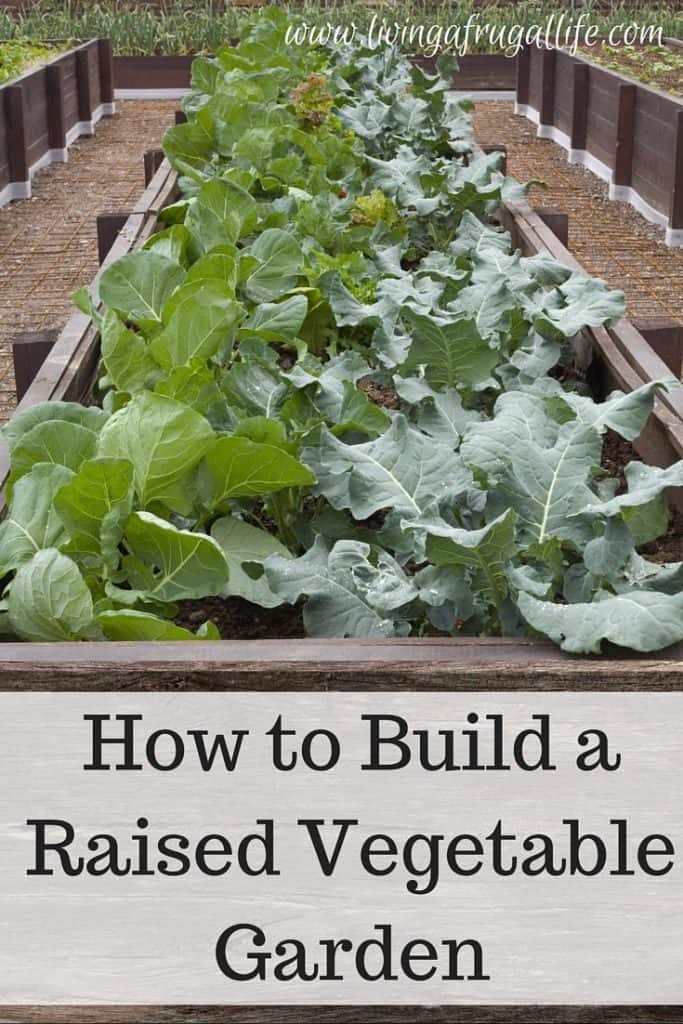

How to Build a Raised Vegetable Garden

Hey!!!! I am Melissa! I am a mother and wife that loves to live frugally, spend time with my family and help others. I think love goes a long way and respect goes even further. I am real on this site because life isn’t always sunshine and rainbows. You’re not alone through all this and I want you to feel right at home. Join me in the ups and downs of frugal life and raising a family in a time where choosing the right isn’t always popular.