August Budget and How We Pay off Debt

Wow, it has been a while since I have done one of these. I am going to come clean and tell you that I hate doing them. Lots of people love to share this because they see what they have accomplished. I am not trying to be negative, but sometimes it reminds me of all the things I didn’t do and what I should have done better.

Now, I am not saying that is a bad thing all the time, but sometimes it is very depressing to see how far we still have to go. I posted a video on facebook about people who were sharing their honest feelings about how the debt made them feel. I could relate so much to what they were saying, talking about the guilt.

One girl described the feelings of “I should have planned better, I should have known better”. That is exactly what I have been feeling. I feel like we let everyone down and we spent so long building good habits that were ruined by us choosing debt. We took steps back in our financial goals just because we didn’t plan well enough.

But at the same time we prayed and knew it was right. I think that is the hardest part about this. We knew it was right, but we feel bad about the outcome.

But enough of the depressing, Debby downer stuff! We are facing our choice and working to pay it off. It will take us a long time and even longer now because we have less to put towards our loans, but progress is progress and hopefully in the end we will see the rewards of our work.

Over the last couple months, we have chipped more and more down into our excess money we used to pay off debt. We have hit the bottom of our excess. We now are only making our minimum payment. But we are adding more to the payments when we can. I think it may be every 2–3 months we may be able to give another $500-$1000.

I am a little sad that we have come to this point, but we realized that we need some savings put in place for certain things like fixing the car, doctors visits, our yearly bills. And now that we have 2 cars for the first time in our married life, we also have to pay for the upkeep and gas for both of those.

My husband’s car is really old with over 260,000 miles on it. It is a Honda so we think it will last, but we also need to save a couple thousand dollars for when this car dies or needs a big fix.

I did not expect it to be this much money going out. I thought we were going to live on almost nothing liek before and use a ton to payoff debt. So this change has been a hard one for me to swallow. But I am getting more and more used to it and if we can endure our apartment for another couple years and Matthew gets raises we will be able to pay off things even faster. I am just trying to be patient through all this which is not easy when we started with so much momentum.

But on to the good stuff! We have made loan payments which have brought our total down to just under $170,000! I am happy to see the number get below that because that means we have paid off over $25,000 in 7 months. When we look at it like that, it seems pretty amazing that we were able to do that. I can honestly say I am SO proud of us for our discipline and for keeping the goal in mind. If we are able to even pay 1/2 that in the next 6 months, I think we will be doing good.

How we pay off debt this month

As of 2 months ago we officially paid off our first loan. This one was $8,500 to start with and had a little interest making it more like $10,000 by the time we paid it off.

We then started to dive head friend into the next loan which was was a little over $46,000. The first few payments were great and we paid good sized chunks on them.

We then found out that If we signed up for auto pay we will be able to get a lower interest rate. Since we are managing our payments so closely I thought it would be a good idea to sign up for them and then just make 2 payments a month. We did and have done this for the last 2 months.

This month I decided to look a little closer to see how the payments were being made and discovered that This may not have been such a good deal.

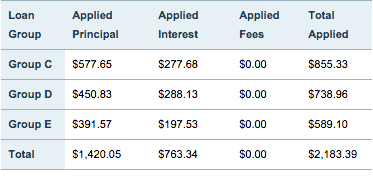

We have been focusing on paying down group A which has the highest interest rate of the loans we have left. When I opened up the payment info I found this….

Do you see that?? They are not paying anything on our loan that we are trying to pay off debt on. We did a little investigating and found that when you pay on your loan ahead, they put off the payment date for that amount that you over-paid. So since we have been paying extra on that loan, They are now not applying any of what we pay to that loan. It is going to all the loans we are not focusing on.

So…. We have decided to call them and see if we can fix that issue and get back on our debt pay-off plan. If they do not let us, we will have to get off auto-pay and go back to us doing everything and have a slightly higher interest rate. We feel like overall we would make the most progress on our loans by doing this option.

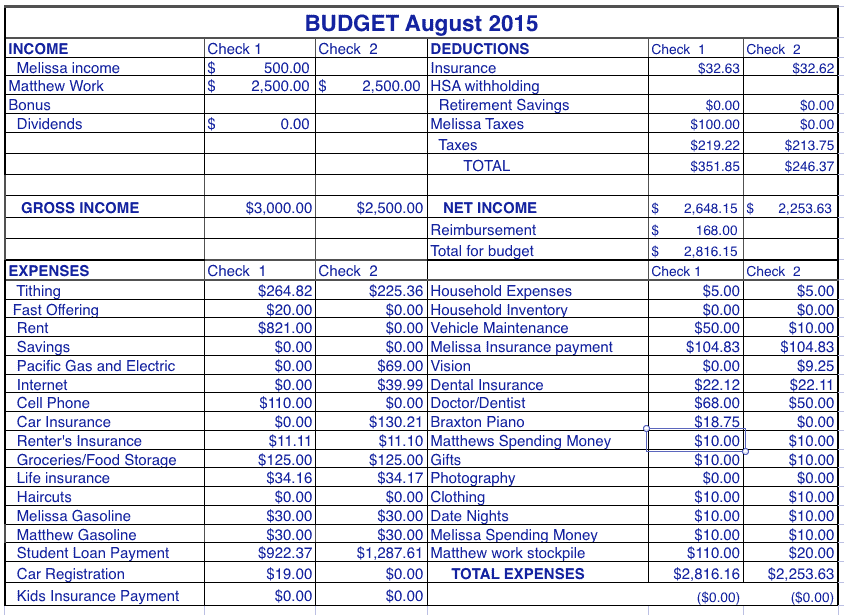

August Budget For a Family of 6

We have been failing at our budgeting over the summer. I hate not having a budget, it adds so much stress to our life when unexpected expenses come up like fixing the AC in our van, which cost us $850 this last month. We had to use our emergency fund to pay it.

We were unsure how we were going to make it work next month with paying that back to the emergency fund and make our loan payment, but the Lord provided with a bonus to my husband of almost exactly what we needed to pay the emergency fund back!!!

That was a huge blessing to us and I know it has come because we have been trying so hard to pay this all back and follow Gods teachings. He is always there when we need him to be and never lets us down!

So this is our budget for this month. I feel like it is finally starting to take much less time to do and it is easier to make work.

Now to stay in budget and figure out ways to make more so we can pay off debt faster with extra payments!

One Comment