Subscribe and get a free printable weekly meal plan that will save you money!

-

5 Tips To Help You Have a Stress-Free Thanksgiving

As much as I love the Holiday season approaching I always dread the stress of getting prepared for big holiday meals and tons of friends and family coming to my home. After years of sleepless nights and panic attacks, I came up with a simple list of ways to have a stress-free Thanksgiving. Using these…

-

Cranberry Orange Chicken Crockpot Recipe

Since we have stopped using coupons, I have started to shop as local as I can to save more money. Foster Farms Simply Raised sponsored this recipe to give me the opportunity to use their locally grown, antibiotic-free chicken as my local shopping includes our meat. Fresno is known for its location for produce, but…

-

Crockpot Saucy Chicken and Rice Recipe On a Budget

I LOVE crock pot cooking! Best thing ever! We also love this recipe. My mom has always laughed because chicken and rice recipes have always been a staple for me since I started cooking. But I think this one is a little different and more “high class” if you will. This healthy recipe is…

Hey!!!! I am Melissa! I am a mother and wife that loves to live frugally, spend time with my family and help others. I think love goes a long way and respect goes even further. I am real on this site because life isn’t always sunshine and rainbows. You’re not alone through all this and I want you to feel right at home. Join me in the ups and downs of frugal life and raising a family in a time where choosing the right isn’t always popular.

Hey!!!! I am Melissa! I am a mother and wife that loves to live frugally, spend time with my family and help others. I think love goes a long way and respect goes even further. I am real on this site because life isn’t always sunshine and rainbows. You’re not alone through all this and I want you to feel right at home. Join me in the ups and downs of frugal life and raising a family in a time where choosing the right isn’t always popular.

Recent Posts on Living A Frugal Life

Beef and Asparagus Meal for Two

14 Ways to Quickly Save Money In The Home

Gardening

How to Start a Garden Growing Vegetables

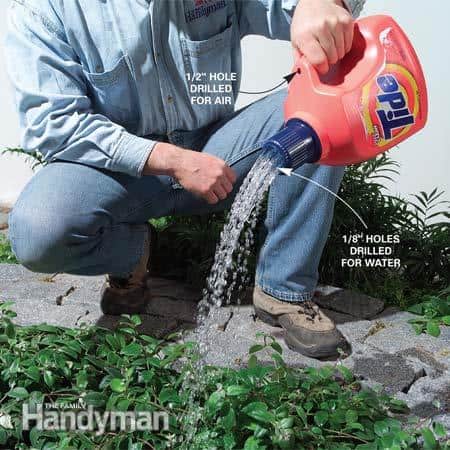

Make Your Own Watering Can From a Laundry Detergent Bottle

How to Garden And Care for Small Vegetable Gardens

Frugal Fairy Garden

Hey!!!! I am Melissa! I am a mother and wife that loves to live frugally, spend time with my family and help others. I think love goes a long way and respect goes even further. I am real on this site because life isn’t always sunshine and rainbows. You’re not alone through all this and I want you to feel right at home. Join me in the ups and downs of frugal life and raising a family in a time where choosing the right isn’t always popular.