The Debt Hole We Dug and How We Are Digging Out Using a Budget

I will get into the whole story of why we made the choice to go into debt later. For now, I am going to just share with you some real numbers and the depth of what we dug. I knew it was coming when we made our choice but to look at the number we have now to pay off it seems crazy!

Honestly sometimes I wonder what the heck we were thinking. I can’t say we would do it the same way if we went back, but there are 2 things we feel it is OK to have debt for. One is a house and the other is an education. Now, knowing that, that doesn’t mean it was easy for me. I don’t care what the reason is for getting debt. It weighs me down big time. So we are on a path to pay this off as fast as possible so we can enjoy the money my husband is making and have a real life with a house and vacations and fun that we have dreamed of our whole life.

A lot of people think it is impossible to pay off your debt quickly when you have as much as we do. But we are doing it! Before I get into how we are paying this off, here is the numbers of what we owe.

All of our debt is student loan debt. Which is all managed by the government now. We have 3 years of 2 semesters each where we took out these loans. We were able to get a couple scholarships during those 3 years which helped a small amount to lessen the debt we took out, but we took out money every year we were there. So as of Jan. 10, 2015, we have $194,633.80 in loans to pay off.

Yes that number is a house. We “bought a house” when we decided to go to school, but we have no house to show for it. We have a degree that has helped him get a job. While I think the amount it cost us to go to school is crazy, we decided to do it and we now have to be accountable to pay it off.

So we sat down after my husband got his job and we started looking at how we would budget this new amount of money we receive each month. The first decision we made early on in our decision to go to law school was that when we were done we would not change our standard of living until we were done paying off our loans. We are luck to live in a great place where the rent is rather low for the area we live. We live in a 1200 sq feet, 3 bedroom apt. We are a little cramped in here but after living in a 950 sq ft 2 bedroom place, this one feels HUGE! We plan to stay in this place until we pay off our debt.

Ok, so now you know the HUGE amount of debt we have here is our plan to get it paid off by the end of 2019 (hopefully sooner). Yes I said in 4 years. We will be paying off our entire debt in 4 years!!!!! If we do some side jobs or sell some items in our house (which we will) it will be sooner, but the longest we will take is 4 years!

To help us to do that, we are going to be posting our budget and our end of the month report on what extras we were able to do to pay things off faster. We are going to be VERY open with everything so you can see what we do and how you can also make needed changed to live a better life.

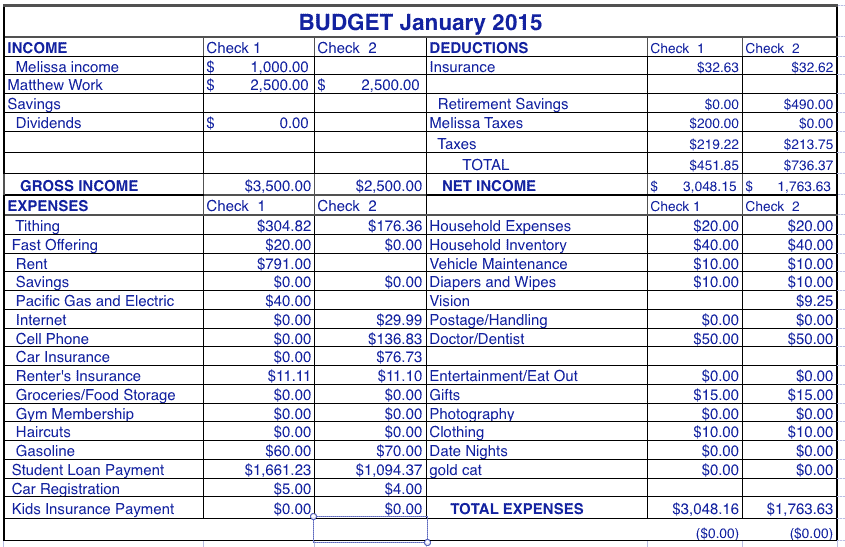

January is the first month we have been able to make a budget like this so you will see little changes over the next couple months as we iron out how much we need in different categories. Due to my husband having a bi weekly paycheck, we are having to use a different budget then we have ever made. It makes me a bit nervous because it is so new tome. I am not sure I am doing this right because he will get checks 2-3 times a month, so each month will be a little different. So I may switch us to a strictly every 2 week schedule if I can’t work it out to be a monthly one. So Here is our budget for the month.

As you can see we are having to scatter some of our bills between the 2 checks and other things we are splitting between each check. We are doing this because some of these are monthly bills due at certain times and the others are yearly or every 6 month bills we are saving for.

I am hoping we will be able to get some more income from selling unneeded items and by earning more on the blog. If Ww do earn a little more, we will be able to put $3,000 on our loans and be 1/2 way done with 1 of our loans!!!!! so excited for that! Can’t wait to check it off our list!

Now to press forward and make more huge dents in our debt so we can be financially free again!

How is your budget this month? What suggestions do you have for us???

Be sure to check out how to budget if you are new at it!

I noticed you didn’t put any money in your budget for groceries. Was that an oversight? Congrats on creating a plan to pay off your debt so quickly! I look forward to following your story and celebrating your accomplishments with you!

Crystal,

Thanks for your comment and for following along! The support is so helpful for us to accomplish our goal. Your question is a good one. Due to the fact that we had very little income the last couple years and lived off loans, we had food stamps. This is the last month we have them. We are going to have a real grocery budget next month.

I was wondering about your car insurance. Your payment is really low. Do you just have one car? My car insurance is one of our biggest bills each month.

We do only have 1 car. That will be changing as my husband is having to travel a little with his work. But he is going to be getting a $1500 car and using it pretty much only for work. We also have our insurance through USAA because both our parents were in the military. We have never been able to find insurance as cheap as them. But if your payment is that high, I would suggest you shop around a bit and see if you can find a cheaper rate. We do that every 6 months or so just to be sure we can’t get it cheaper other places.

You don’t need gas for your car?

Does it scare you that you don’t put away for savings?

Hi Marisa,

Thank you for your comment. The gasoline in the budget is the gas for our car. We have a $1000 emergency savings account that we have had for the last 4 years. While we are paying off our debt this is our only savings. It gives us a back up for problems that arise. Because we are focusing on paying off our debts, we will have a lot more money to put into savings later for retirement or other things. It will be a whole lot easier to save a large amount quickly after all that money going toward our debt is no longer tied up in that. It does take trust in the Lord to do this for some people, but it works and is very comforting to see that total in debt going down.

Thanks for the article. I was searching for ideas to help payoff my student loan and came across your blog. It has inspired me to set up my own budget. I hate to mention this be isn’t this a five year plan? (January 2015 – December 2019) – maybe easier calculated as beginning January 2015 and ending January 2020.

Hi Lou! Thank you for the comment! I am so excited for you to start your budget! if you need any help or have any questions, feel free to email me. I think you will find a really big sense of relief and control that you never had before! Yes technically it is 5 years at the longest. But I am aiming for august or earlier in that year so it less then that. I think we can make it no problem if we keep on course and work hard to make it happen! do you have debt your paying off?