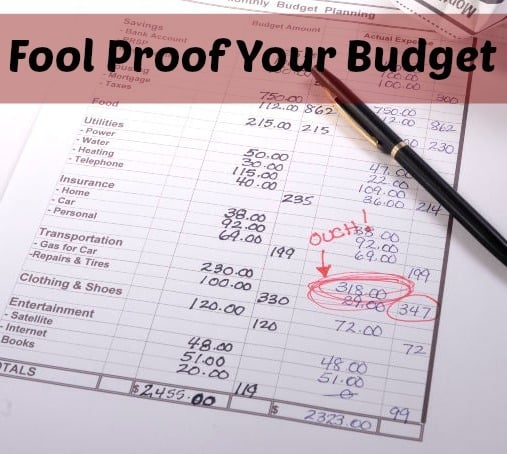

5 Personal Budgeting Tips To Make A Home Budget Foolproof

Budgeting tips can help you be a better financial manager. But making a budget can be a very hard thing when you are just starting out. You write down your home budget and you say you’re going to follow through but it never seems to happen.

There are many budgeting tips that can help you foolproof your budget so that you don’t overspend. This process can include a daily check in with a spouse or a friend. Here are 5 personal budgeting tips to make a home budget foolproof and not go over budget each month.

5 Personal Budgeting Tips To Make A Home Budget Foolproof

Write your budget by hand

While this may take longer, it is a great practice to get used to so you are able to use your mind more so it becomes more concrete. The more time you spend writing it the more your brain will solidify your desire to live by what you write.

This can also help your home budget to be balanced because you have to really think about what you are writing. If you need more help on how to make a budget, check out this post!

Use cash for your everyday purchases

This does 2 things, helps you to be accountable and helps you to not overspend. You are accountable because you have to check your purchases and be sure you have the money for it. It helps you to not overspend because if you shop with cash, you have what you have and can’t spend a cent more.

Have a friend who helps you

Talk about it with your spouse or someone who will give you the encouragement and advice that helps you to stay in budget. This is also helpful for them to help you stick to parts of your budget that you struggle with.

They can help you to manage your spending as well. You can run purchases by them and they can follow up with you on how you are doing. They can also celebrate with you when you follow your simple cash budget.

A goal you’re trying to achieve

When you have no goal there is no reason to move. You would just be aimlessly wandering if you had no goal. This is the same with finances. Without a goal, you just spend what you have and have a direction to move in.

This is why it is so important to set a home budget goal. It gives you direction to when you have a goal and deadline for that goal you are motivated and more aware of yourself and your spending.

Post your budget or goal somewhere you see it every day

When you can see your goal every day you are reminded of your promise you are making to get there. It also helps you to be analytical in your decisions so you are able to make things work how they need to to make your budget and money work for you.

More posts from Living A Frugal Life

7 Budgeting Activities To Teach Your Child Money Management

Free Printable Monthly Bill Tracker To Teach You How to Track Individual Bills

4 Comments